4 Questions Policymakers Need to Answer on BEVs

Where will the power come from?

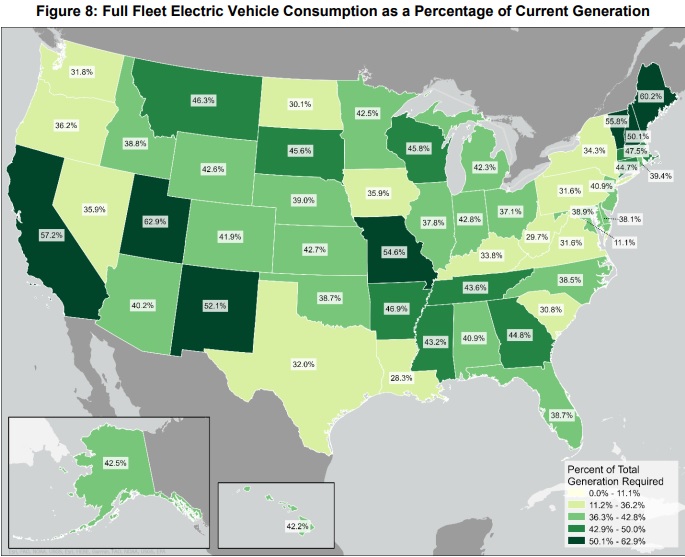

New research from the American Transportation Research Institute exposes severe limitations for the U.S. electricity grid when it comes to electrifying the nation's vehicle fleet. Converting all vehicles to battery-electric would amount to more than 40% of the nation's current electricity consumption. For freight trucks alone, 14%. California, for instance, will need to increase its electricity generation by more than 57.2% to convert all vehicles to battery-electric, at a time when the state already experiences rolling blackouts.

Where will the batteries come from?

To mass produce lithium-ion batters, tens of millions of tons of cobalt, graphite, lithium and nickel will be needed, which could take as long as 35 years to acquire given current levels of global production. Expanding that capacity creates a giant environmental footprint, producing considerably more CO2 and pollution than the manufacture of internal combustible engines. In some operations, a minimum of one million gallons of water are used to produce a single pound of lithium.

Moreover, child and other exploitive labor practices are common in many of the countries that produce these minerals. In the Congo Republic, which exports more than half of the world's total Cobalt, at least 40,000 children are enslaved in the labor trade according to the United Nations.

When will the infrastructure be ready?

The trucking industry already faces a chronic and severe shortage of commercial truck parking nationwide, which strains the supply chain and jeopardizes highway safety. Electrifying the nation’s truck fleet would require more chargers than there are parking spaces currently. Bear in mind that the truck charging needs at a single rural rest area would require enough daily electricity to power more than 5,000 homes.

Lithium-ion batteries also dramatically increase the weight of trucks, meaning less freight and revenue per truck, leading to more trucks on our roads and more traffic congestion.

What will this mean for the supply chain?

Electric trucks are also significantly more expensive; a typical new Class 8 diesel tractor costs around $135,000 compared to a Class 8 BEV, which prices around $400,000 on the low end. Considering 96 percent of U.S. trucking companies are small businesses that own 10 trucks or fewer, these prohibitive cost increases will decimate countless trucking fleets across the country.

Trucking now moves 72.5% of our nation’s freight tonnage. Over the next decade, trucks will be tasked with moving 2.4 billion more tons of freight than they do today. The moment that slows or stops, Americans will want answers.